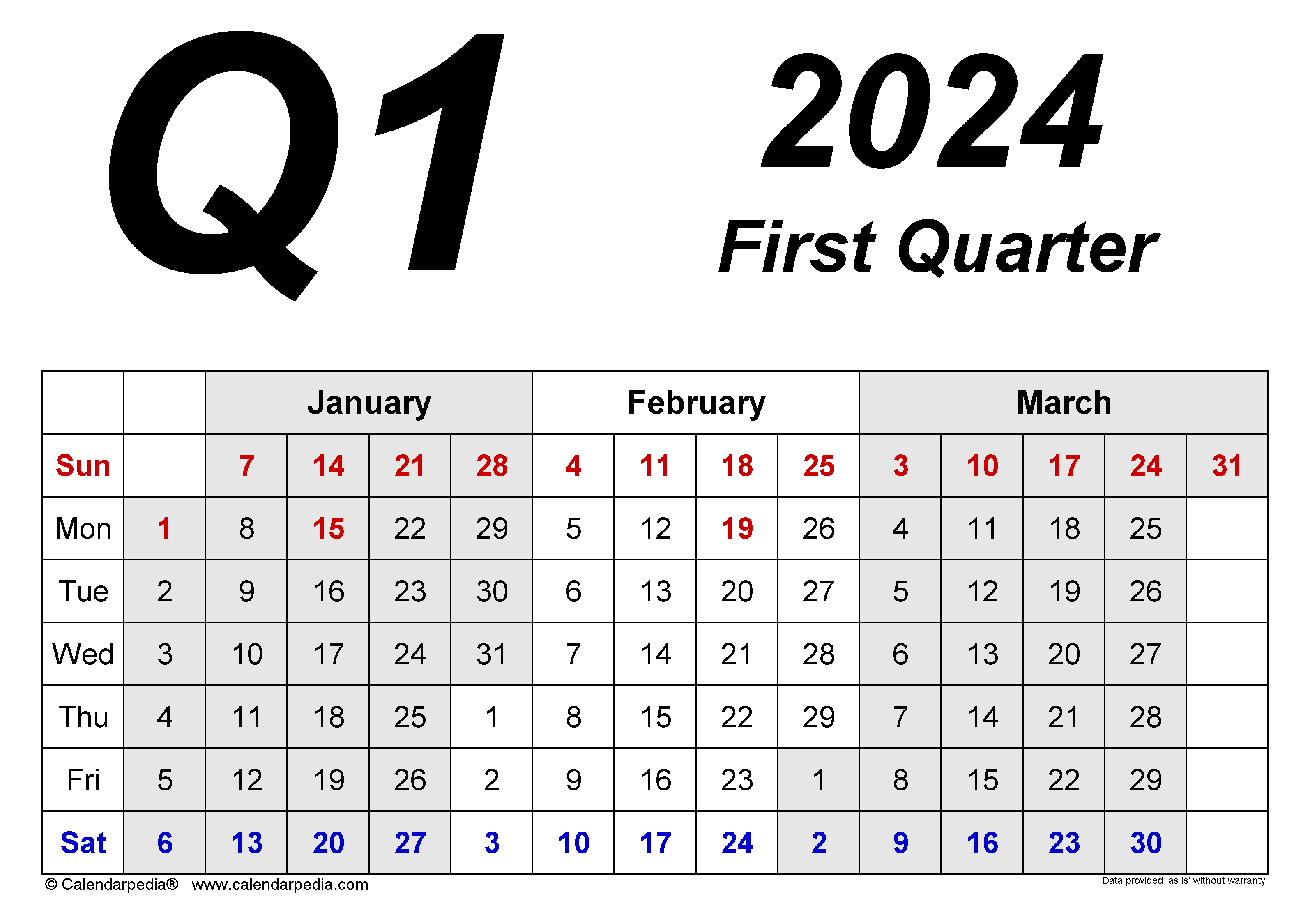

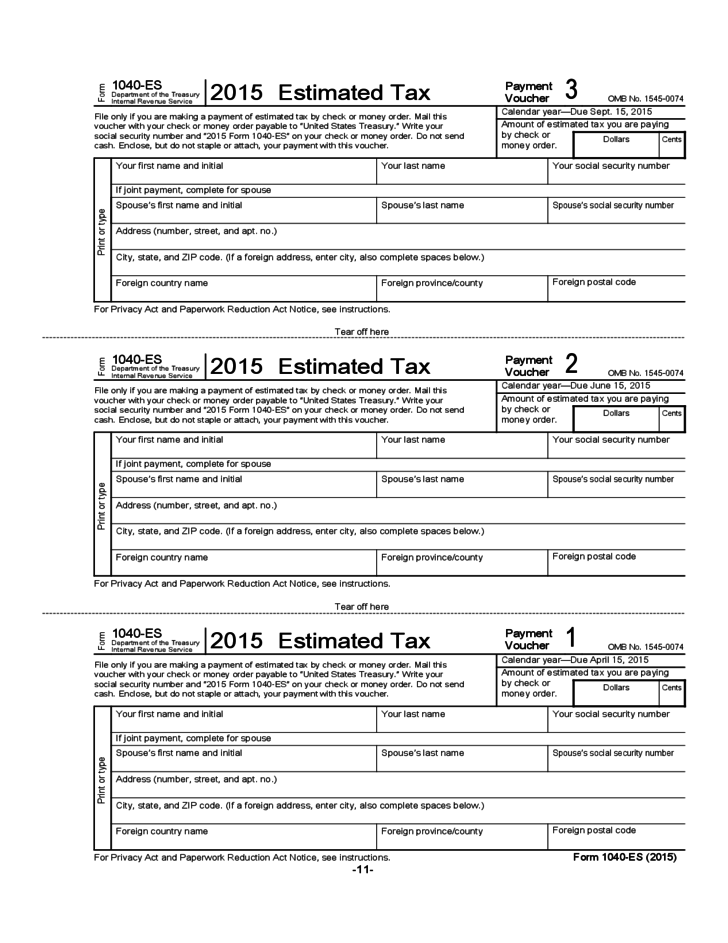

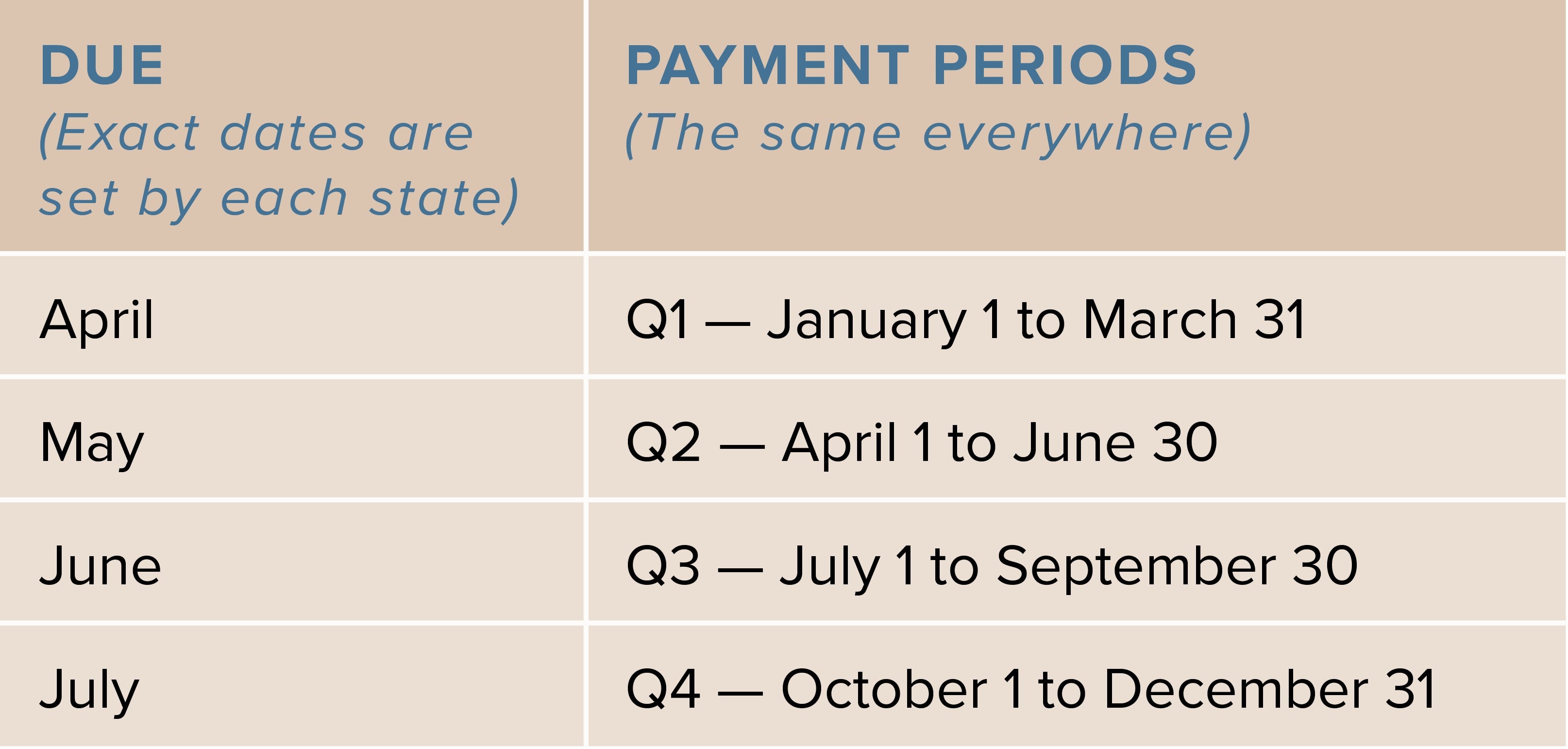

2025 Quarterly Tax Payments. No, you are not required to do anything with those estimated tax vouchers for 2025. Quarterly estimated tax payment deadlines fall on the 15th of the month in january, april, june, and september.

Quarterly returns, monthly tax payments. This article provides an organized compilation of the due dates for compliance related to gst, income.

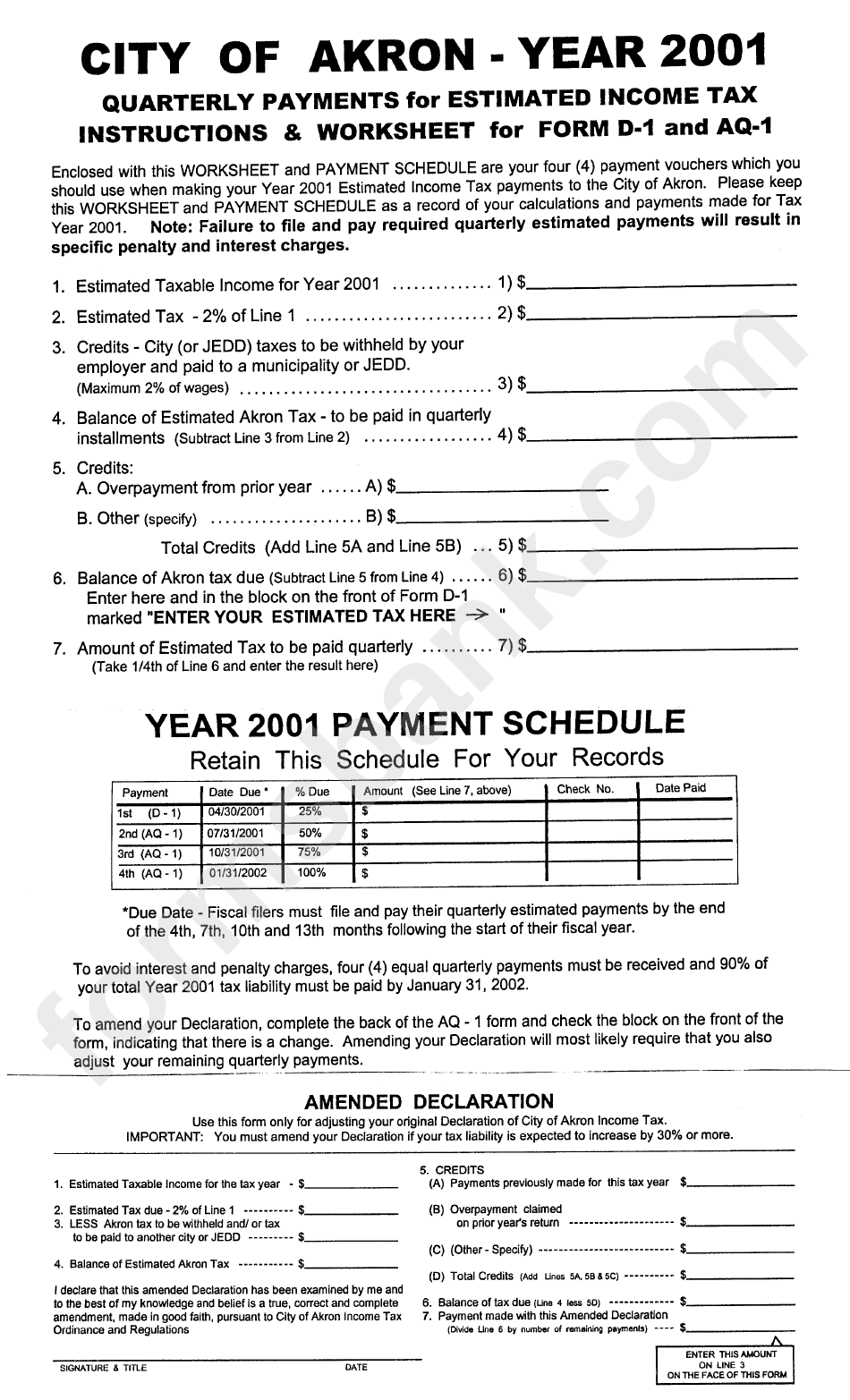

Quarterly Tax Payments 2025 Schedule Eula Rosemarie, Quarterly payroll and excise tax returns normally due on oct.

2025 Quarterly Tax Due Dates In Hindi Rubia Claribel, View amount due, payment plan details, payment history and scheduled payments;

Quarterly Estimated Tax Payments 2025 Form Bobbie Margit, Possessing this mindset could help you maximize tax.

2025 Quarterly Tax Due Dates In Hindi Flora Jewelle, You'd expect to owe at least $1,000 in taxes for the current year (after subtracting refundable.

Quarterly Tax Payments 2025 Schedule Eula Rosemarie, In most cases, you must pay estimated tax for 2025 if both of the following apply:

Irs Quarterly Estimated Tax Payments 2025 Grata Karlene, Use a quarterly tax calculator, enter all the basic tax information required and get a tax breakdown of your total liability and quarterly payments.

California Quarterly Tax Payments 2025 Schedule Morna Brandice, Learn about quarterly estimated tax payments for individual income tax, including due dates and how to pay estimated taxes on your taxable income.

When Are Quarterly Taxes Due 2025 Mn Cam Noelani, Optimize gst compliance with the qrmp scheme for small taxpayers.

2025 Tax Deadlines for the SelfEmployed, Reported net loss of $3.3 million and net income of $3.7 million for the three and nine months ended september 30, 2025, respectively.